I have a short note to add for those still reading and following my blog...

Firstly, the last day of the world isn't quite the last day of the world.

See this PAGE

Secondly, for those who have heard, a number of us traders have been saying that it jolly well could be the end of the financial world as we know it... and so it seems, the end of the dead cat bounce was just a couple of days ago, SELL signals given in the daily charts in the last two days, and just now it looks like a confirmation reversal is in play. There goes Santa...

Finally, I am writing from Perth, Australia.

For those who know the significance of me being overseas... good on ya. Do leave a message if you happen to read this, and just stamp chop your agreement that what I had told you before is true.

Well, what is it? Instead of the markets dropping a whopper when hair is cut (like Conrad Alvin Lim)... the markets tends to tank real hard when I am away. This is an estimated 70-80% accuracy since 2009. Initially identified by my brother, and then my spouse and close friends also began to realize it happening.

For the times I can remember...

I was in Tokyo, Japan in Nov 2008

I was in Melbourne, Australia in Jan 2009

I was in Berlin, Germany in Aug-Sep 2009

I was in Kansai region, Japan in August 2010

I was in Perth, Australia in Nov 2010

I was in Santa Fe, New Mexico, USA in February 2011 and then in Melbourne, Australia in March 2011 when the massive Japanese earthquake struck

I was in Bangkok, Thailand in early October 2012

and I am now in Perth, Australia... December 2012.

Take a look at these periods... definitely no bull (run) there. Either turnaround times, or retracement, or some downward shifts in the market.

An intriguing correlation there...

Meanwhile, as I take my time analyzing charts in my holidays (if at all), I'd like to wish all readers a Happy New World, Merry Christmas and Happy New Year!

Live life to the fullest and do something different everyday.

The MadScientist

22 December 2012

Friday, December 21, 2012

Tuesday, August 14, 2012

Beauty and Grandeur of Niagara Falls

Niagara Falls from the Canadian side

Downstream of Niagara Falls

Monday, August 13, 2012

Near the Highs of the Year - Market Analysis for August 13th 2012 by Singaporeseeds

Afterwards I drove to Niagara Falls through Ontario, Canada

and struck the majestic Falls off my bucket list. Will post a video of it later.

Then it was to Kingston, New York where I met my long-time

trading buddy who is working there and then onwards to New York City.

At New York City, I was gazing at the big banks there and

fooling around with the ex-Merrill Lynch bull and wondered how it would be like

to run a bank. Over the next few days, I just can’t get the thought out of my

mind. It will be really fun to make money from nothing but obviously you will

need expertise, knowledge and the capital for it. And I’ve not checked but I

assume you need a license for it.

Anyway that was exactly a week ago. Over the last 7 days, I

thought that if I am to start a bank and also succeed, it cannot start it in a

developed country. The established players will destroy me before I can start

an office. So it has to be somewhere unsaturated, where people are still

foreign to the concept of leverage and then get someone who has experience in

bank operations into this with me. And if it is not a developed country, I

would definitely need someone with connections to get the license. Lastly would

be the capital.

For the capital, I’ve come up with a list of people whom I

can call up. So that part’s settled. I’ve also decided on the country and also

know a couple of people whom I know have the power and connections to get

almost anything they want. So what’s lacking now is someone with expertise but

as a person who believes in divine intervention and believes that he’s doing

God’s work, I just have a feeling that I will meet this person soon.

Daily chart for S&P

Daily chart for Dow

Daily chart for NASDAQ

Anyway nothing much has happened over the last 2 weeks. We

are still overbought with low volume. Seems like this has been the case over

the last 5 weeks and the market is waiting for something to move it in either

direction. From my charts, the uptrend has ended last week but I think we

should only see movement after this Wednesday.

Daily chart for the Dollar

The dollar dropped as expected and is starting to get

oversold. There is a strong support around 81.6. We should see it stay above.

Daily chart for Gold

Gold is still forming a base with no breakouts either way.

However my longer term charts is telling me that the chance of a breakout

upwards is more likely.

Sunday, August 5, 2012

Conrad and the WAT course

Just found out that my blog was selected by Conrad's Appreciation post on Pattern Traders. So just want to reply to his post.

Conrad's WAT course was the defining course in my business & trading career. I started doing business 2005 when I was still in university. Went full scale into it in 2007 when I graduated. Took Conrad's course in early 2008 and it was from Conrad and his WAT course that I found out the scale of the market panic that was going to happen later that year. I dare say that if I had not known about Conrad and the stock market cycle, I would had went bust. Having the ability to make sense of stock charts and market cycles saved me from financial ruin. And I have Conrad to thank for that.

The WAT course is not just for stock traders. It is much much more than that. It is about making sense of the financial world and learning to play the money game. If you are interested in financial success, I would definitely recommend Conrad's WAT course.

Conrad's WAT course was the defining course in my business & trading career. I started doing business 2005 when I was still in university. Went full scale into it in 2007 when I graduated. Took Conrad's course in early 2008 and it was from Conrad and his WAT course that I found out the scale of the market panic that was going to happen later that year. I dare say that if I had not known about Conrad and the stock market cycle, I would had went bust. Having the ability to make sense of stock charts and market cycles saved me from financial ruin. And I have Conrad to thank for that.

The WAT course is not just for stock traders. It is much much more than that. It is about making sense of the financial world and learning to play the money game. If you are interested in financial success, I would definitely recommend Conrad's WAT course.

Saturday, July 28, 2012

Lonely New High – Market Analysis for July 30th by Singaporeseeds

Daily chart for S&P

As I’ve mentioned in my previous post, the start of the

downtrend will be when the MACD Histogram turns red. It looked like so until

last Thursday when we moved higher on very light volume hence a lonely new high supported

only by a few players. We are 2 days left before

the end of the trading month and it is still green so I suppose this is not the

time yet. In fact, it looks like we are going to make a new high for the year.

From what I see on my charts, as long as we stay above

support at 1366, we will remain bullish. First support at 1366, then 1310.

Daily chart for the Dollar

The Dollar (UUP) failed to break resistance at 83.7 and made

a failure movement. If it ends down on Monday, it will confirm the downtrend.

First support at 81.6, then 79.

Daily chart for Gold

Gold broke the wedge that it had been in since December

2011. This is the start of the next leg up for gold. We might dip a bit over

the next few days but we should see gold (GLD) rally over the next few weeks.

Support at 156.73. Resistance at 164.5 and 174.

Daily chart for Crude Oil

Crude Oil (USO) just made a bullish set up. Confirmation

will be when it breaks about the 50 day moving average at around 34.6. Before

that happens, it is still technically bearish.

Tuesday, July 24, 2012

Just before all hell breaks loose - Market Analysis for July 24th 2012 by Singaporeseeds

It’s been more than a month since I last wrote my market

analysis. I went to Myanmar, got to know some really good friends, met up with

many old ones and in the process, got to know myself a lot better. I was told

this year will be a year of opportunities for me, but I would prefer to say

that this is the year I broke my own limitations and realised there were

actually nothing stopping me except for those in my own head. From the long

cold journey to catch the aurora borealis in March to planning a retail outlet

in Myanmar, all these were unimaginable 2 years back when I can barely go out

of my house for more than an hour before I started feeling giddy and weak. Just

last week, I recovered from gastric flu after a good night’s sleep when usually

it would have taken me a week to do so.

As for the one month hiatus, it happened because I had to

travel to Myanmar and without the readily available internet connection; I had

to exit all my positions. But I was so busy over the next few weeks that I did

not have time to look at the market until now. And luckily I did.

Monthly chart for S&P

The monthly chart for the market rarely forms bearish

divergences but when it does, it goes down in a bad way. As you can see from

the yellow trendlines on MACD, it had happened twice since 1996 and both times

the market dropped for more than a year. Just based on chart symmetry, I can

say that we will be going down to around 600 on the S&P in within a year’s

time from now. Right now, the MACD histogram is shortening and when the month

ends in a down red histogram, it will be the signal for the start of this

year-long downtrend.

I’ve spent the whole of last week arranging to sell off all

my stock certificates, unit trusts and accumulating cash on the sidelines. When

the drop happens, property will also be hit and I’m waiting to scoop up at

least one property in UK when that happens.

Anyway be prepared for another round of global recession. We

are now halfway through a major 20 year sideways cycle that will end in

2019.

Daily chart for S&P

Daily chart for Dow

Daily chart for NASDAQ

On daily charts, all three indexes are showing a bearish

divergence. However we are now at a range of support levels and I’m looking for

follow through after 2 down days. We should be around 1,286 by end of this

week.

Daily chart for the Dollar

There is a bearish divergence for both dollar index futures

and UUP. The dollar usually moves in the opposite direction of the market and

with the very bearish outlook of the markets, I believe it should rally very

soon. So I’ll be looking out for failure signal for this bearish divergence.

Daily chart for Gold

Gold seems to be forming a base around 1550 for a year now.

I have a wedge pattern on daily with volatility decreasing. Whichever way it

breaks out from, it’s going to be a big movement.

Thursday, July 12, 2012

Radio check, over... 12 July 20012

It's been a while, and during this time, there has been a nice dead cat bounce.

Today's post is about a possible end to this dead cat bounce rally as we are technically at a decision point turnaround.

/ES

The weekly ES (S&P500 futures) chart show a bounce off the moving averages and a possible failure to make a new high. What is not seen is a reversal of a trend IF the ES closes at its current level or below this Friday. Zooming into the daily ES chart, a uptrending support line is just about to be broken. Having a Sell Signal earlier in the week, with extended indicators as well as a potential bearish crossover of the moving averages, a break of this uptrending support line would see the daily 200 moving average be the next support test, which coincides with the previous low. Price action beyond this low by Friday means a break of the weekly and daily uptrend.

In essence, it technically looks like a turnaround point... however, we are looking for trigger events to bring this successfully into fruition and with much further downside.

In essence, it technically looks like a turnaround point... however, we are looking for trigger events to bring this successfully into fruition and with much further downside.

/DX

The USD futures weekly and daily charts are showing a renewed interest in a rally. With a new recent high made, it indicates a continuation of the rally un USD. With this, a drop in equities (ES) is correlated. The recent run up in the USD is technically supported by indicator as well as moving averages and the market fueling of the EUR/USD dumping to all time lows

/GC

This is a favourite... cos it is a tad challenging. So many people I know are so bullish on Gold, that it is about time Gold does some distribution. The weekly gold futures chart show the recent Gold double top peaks that had prices test 1550 on many occasions. There seems to be a traiangle formation and indicators are showing a potential divergence. Yet, gold is not breakout and have been ranging over the ast few weeks. The daily charts show that clearly and uite differently show prices below the moving averages with undecided price action and technicals. All said, the range bounadries are closing in and a breakout or breakdown is due... watch for this.

/CL

Crude futures in recent weeks have had a tough time, and clearly breaking an uptrend. Expect a short term bounce and consolidating range between 80-90.

So there... things are at some decision point. My warnings of a fall in the markets since March 2012 had materialized in May 2012 and since the market has had a bounce... possibly a dead cat bounce. Between now and October, something might happen to pull the markets one way or another... something not seen. IF the markets rally, it is likely to overextend itself and not expecting it to be higher than the high at the beginning of the year. This may be a setup just like it was in July 2008 to September 2008. I am looking for the signs... it might do us all well to keep a look out too.

Fundamentally, everyone is yet again bailing and easing... this time, the markets aren't reacting with that much favour. One might ask oneself why so... and let's keep our eyes out for the answer.

Have a good weekend ahead!

The MadScientist

13 July 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Labels:

MadScientist's Market Analyses

Monday, June 4, 2012

Cyprus Next in Line to Seek a Bailout - Market Analysis for week of June 4th 2012 by Singaporeseeds

Daily chart for S&P

Daily chart for Dow

Daily chart for NASDAQ

I wasn’t able to blog about the market last week as my

in-laws were visiting. We did a road trip from London to Newtonmore in

Scotland. We saw the British Dance Open in Blackpool and visited St Andrew’s

Old Golf Course in Scotland. Also went to numerous sightseeing spots along the

way. This Thursday, I’ll be going to Rekjavik, the Golden Circle Route and will

be feasting on the delicious seafood in Iceland.

Anyway back to the markets….I saw an excellent short entry

for the markets on Monday that I took just before I left on the road trip. The

markets dropped like a brick over the week and we entered oversold conditions

on Friday. We might bounce as far up as 1,345 over the next few days before

continuing down to 1,150 for S&P. It is still a downtrend and any rallies

will be better entries for shorting.

Recently there’s speculation that Cyprus may be seeking a

bailout from the EU. This and a few other really pessimistic news coming from

Europe should be enough to keep the market from rallying much.

Daily chart for Gold

Quote from my market analysis 2 weeks ago:

“We had gold bounce off support at 1,546 last Thursday. I

believe we should see gold test this support again within a week or two before

beginning a new rally.“

Gold tested support over the following 2 weeks before making

a huge one day rally spike last Friday. This is the beginning of the next rally

for gold. I was unable to enter a long position as I was driving somewhere in between

the Grampian Mountains gazing at the breathtaking views of the loch and glens

of Scotland.

We should see gold rally over the next few days and then

come back down to test channel support. That will be a good and safer entry for

the next leg up.

Friday, June 1, 2012

What time is it? 1 June 2012

I posted this on my FB Timeline yesterday...

"Ok... Haven't had proper time to blog it... But I am officially worried about the global markets. The price action and overall feel is really uncanny to a couple of years ago. When I get bad vibes, it usually means something.

All the pieces seem to be in place. The time for opportunity is upon us."

And what happened later in the trading session was a (dead cat bounce). Today, about 2 hours ago, the S&P500 started to drop and is currently down 15 points. While I expect a Friday in this climate to be down usually due to not wanting to hold over the weekend, this is more than that. And the usual first day of the month bullish tendency doesn't look anywhere near.

Well, it seems that I am not the only one feeling the bad vibes... Conrad also posted about a feeling of some geographical bad feeling... And only a few minutes into writing this blog post did he post a report on an earthquake in Tokyo.

See: https://www.facebook.com/conradalvinlim

Co-incidence?

I think not...

Some are more attuned to "energy" forces and if we listen hard enough, it's what others call a vibe.

Anyways, this is just one of those things that we independently felt and posted... What it means really will depend on you the reader to decipher. Point being, take heed.

The MadScientist

"Ok... Haven't had proper time to blog it... But I am officially worried about the global markets. The price action and overall feel is really uncanny to a couple of years ago. When I get bad vibes, it usually means something.

All the pieces seem to be in place. The time for opportunity is upon us."

And what happened later in the trading session was a (dead cat bounce). Today, about 2 hours ago, the S&P500 started to drop and is currently down 15 points. While I expect a Friday in this climate to be down usually due to not wanting to hold over the weekend, this is more than that. And the usual first day of the month bullish tendency doesn't look anywhere near.

Well, it seems that I am not the only one feeling the bad vibes... Conrad also posted about a feeling of some geographical bad feeling... And only a few minutes into writing this blog post did he post a report on an earthquake in Tokyo.

See: https://www.facebook.com/conradalvinlim

Co-incidence?

I think not...

Some are more attuned to "energy" forces and if we listen hard enough, it's what others call a vibe.

Anyways, this is just one of those things that we independently felt and posted... What it means really will depend on you the reader to decipher. Point being, take heed.

The MadScientist

Sunday, May 20, 2012

Downtrend Part One - Market Analysis for May 21st 2012 by Singaporeseeds

Daily chart for S&P

Daily chart for Dow

Daily chart for NASDAQ

What a week! The US market had its biggest drop since August last year. And according to my charts, it seems that this is only the beginning. We should get at least 2 waves down and we haven’t even completed the first down wave so this is going to be big.

I believe support for this first down wave should start to come in around 1,280 on S&P futures. We are just 10 points from that so I believe we should get a bounce sometime next week. It’s going to get a lot more volatile and exciting as the roller coaster gains speed.

The second wave should bring us down to around 1,150.

On the Dow index, there’s a broadening wedge. This chart pattern indicates increasing volatility and usually does not end well. We may see a bounce to test the bottom of the trendline of the wedge at around 12580 but we are definitely going be end the month much lower than where we currently are now.

Daily chart of the VIX

Volatility had been increasing rapidly over the past few weeks. And as my trading buddy Chris had mentioned, we had begun a new volatility cycle sometime last month. And we should see increased volatility in the markets over the next 3 months.

Daily chart for Gold

We had gold bounce off support at 1,546 last Thursday. I believe we should see gold test this support again within a week or two before beginning a new rally.

Daily chart of the VIX

Daily chart for Gold

Saturday, May 19, 2012

What next week brings... 19 May 2012

Oh what a week!

Global markets tanked in the midst of uncertainty and looks like there may be more to come.. the "Sell in May and Go Away" sure worked this round. Not to be too surprised as the market was way overbought as April ended.

So what does this week's technicals tell us to expect of next week?

/ES

The S&P weekly chart is clearly is not in a bullish trend any more. A sell signal and momentum confirmation is a good indicator of downside for the S&P500 futures over the next few weeks. The daily chart is a little extreme in the bearishness, being oversold and looks to bounce (dead cat) some time later next week, but not before a tad more downside early in the week.

VIX

The volatility cycle has started about 1.5 months ago, and this week confirms a breakout to the upside in the weekly chart. The daily chart is also a little extreme but looks to corroborate with the /ES analysis of spiking early next week, and then retracing later in the week.

/DX

The USD futures are clearly having a good rally. With higher USD, lower Crude, Gold and Equities. Need I say more?

/GC

Gold hit the support and buyers entered the market to give an awesome 2 day rally to recover the Gold price. However, from the weekly chart, I am a little cautious about this rally and rather wait out at this point. Gold buyers are acting on the Euro contagion uncertainty, but in a true panic, these will be washed out nonetheless. The weekly chart is confirming lower Gold prices, but the daily shows a bounce off 1540 support level.

AAPL

Again, featured as I am watching this closely, particularly after a parabolic run which was followed by a topping pattern. The weekly chart is favourable for further downside over the next two months. The daily chart is similar, even having moved significantly downwards over the past three weeks, it is still signalling an immediate downside into the coming Tuesday before a potential technical bounce is expected. Monday should open down for the morning session.

It's really bearish, and I suspect that Facebook breaking below $38 would pressure the NASDAQ to sell off.

DBA

Ah... my favourite, play for the next 10 years... Soft commodites. Despite a drop across almost all market sectors, DBA (Sugar, corn and wheat ETF amongst other things) actually had a buy signal on the daily chart. This follows a bullish divergence and a bounce off the extremes. The weekly chart has a bullish engulfing that is probable to work. This one is good for going long long term IMHO.

Be safe, have fun!

The MadScientist

19 May 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Labels:

MadScientist's Market Analyses

Thursday, May 17, 2012

Sell in May & Go Away - 17 May 2012

A quick but very important note...

The Sell signals are firmed and it is obvioously clear that the rally has ended. It is time for a correction, one that it fulfilled by the events in Greece (and Europe), at least for now and the months to follow.

ES charts show confrimed sell signals that were given as early as 1.5 months ago. The topping pattern is completed and indicators are compellingly clear.

Find the charts in HERE

The volatility cycle is also starting, with Buy signals confrimed and the VIX has a breakout.

The USD futures (/DX) also clearly show a run into safe haven...

AAPL is a feature... this was a market leader as it accomplished a parabolic run, and now it is clearly correcting, as a leader on the downside as well.

Gold futures point to a make or break on support levels. This snapshot fo the chart was taken at midday yesterday, and today a very strong bounce is lifting gold futures more than $30. This one should be watched closely although I think that a panic would send gold sharply down before a real rally to >$2000.

This is the time to be really aware and perhaps take appropriate action where necessary sooner than later. It will be more volatile from now till September to October as I expect.

Be safe.

The MadScientist

17 May 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

The Sell signals are firmed and it is obvioously clear that the rally has ended. It is time for a correction, one that it fulfilled by the events in Greece (and Europe), at least for now and the months to follow.

ES charts show confrimed sell signals that were given as early as 1.5 months ago. The topping pattern is completed and indicators are compellingly clear.

Find the charts in HERE

The volatility cycle is also starting, with Buy signals confrimed and the VIX has a breakout.

The USD futures (/DX) also clearly show a run into safe haven...

AAPL is a feature... this was a market leader as it accomplished a parabolic run, and now it is clearly correcting, as a leader on the downside as well.

Gold futures point to a make or break on support levels. This snapshot fo the chart was taken at midday yesterday, and today a very strong bounce is lifting gold futures more than $30. This one should be watched closely although I think that a panic would send gold sharply down before a real rally to >$2000.

This is the time to be really aware and perhaps take appropriate action where necessary sooner than later. It will be more volatile from now till September to October as I expect.

Be safe.

The MadScientist

17 May 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Monday, May 7, 2012

Daily chart for Dow

As you can see from Dow futures, there had been a false upside breakout. Price broke and made a new high on May 1st but promptly dropped and closed below the 50 day moving average. This coupled with a bearish divergence on RSI, Force index & a bearish trendline for RSI is a strong indicator that we are going down for the next few weeks. This bearish divergence is also present for S&P and NASDAQ.

If we are going to continue to rally, all 3 indexes will have to move above their 50 day moving average (13,000 on Dow futures & 1380 for S&P) and stay above.

See following for the daily charts for S&P and NASDAQ

Daily chart for S&P

Daily chart for NASDAQ

Should the market fail to keep above these levels, we should see Dow falling to around 11,140 and S&P going to 1200.

Daily chart for Crude Oil

Crude oil gapped and dropped last Wednesday when the market realised that the economy was not as resilient as they thought it was. UK was in a recession for the first 3 months of the year while Europe was still struggling with the European Union mess. Everyone who believed US was finally on its way to recovery realised that recovery still had a long way to go. Crude oil, which was one of the most important drivers of the economy, got a real 3 day beating.

Daily chart for Gold

As for Gold, it had been building a bullish divergence for a couple of weeks now. It had been going sideways for 2 months now and I believe it should start a new rally in a few days.

The Bulls have left the farm! 8 May 2012

Written on 6th May 2012 but due to technical fault, images were lost and post not updated.

About a month ago, there were clear sell signals in the S&P500 futures, /ES. This was highlighted in my last blog post, and then followed by a dead cat bounce. As of last Friday, after the non-farm payrolls, the bulls have little left and it is about time to watch the bears march in...

So far, the expectations have been playing out accordingly...

ES

The S&P500 futures weekly chart stalled in April, and last week ended with an indication of the start of a new trend... Down. The daily chart had a sell signal last Thursday, and Friday's close reaffirmed it. All other indicators are showing bearing inclinations, and price action targets the previous low as a break point for support. Once a lower low is registered over this week, a top is confirmed, and perhaps it would be a volatile ride down all the way till almost the end of this year.

VIX

The VIX charts are also reaffirming the ES outlook in that the next volatility cycle is upon us. A Buy signal on the weekly is valid and the daily breakout of the last high would confirm.

DX

The USD futures suggest USD upside in the near term. Hinting of lower equities prices.

GC

At this point, I want to specially mention one of two highlights. First being Gold futures. Regardless of what others say, I see that Gold is weakening and not ready for a rally. Strangely, a hint of a quick dip appears to be on the charts. This is observed in the weekly chart from the MACD, and the daily Buy signals that have been anulled.

AAPL

Apple is the other highlight... and this is one obvious tanker.

AAPL had gone parabolic and extreme. The stall was expected, and then we saw Sell signals which saw the daily price work its way to the 55EMA. Immediately after that, AAPL released its results and a huge gap opened. There was no "gap and run" and instead stalled. Then Sell signals appeared which coincided with the weekly trends. Last Friday clearly indicates that AAPL is heading much more down... next stop at 535.

Clearly, I have positions in AAPL.

And also see what one of my teachers wrote about AAPL a couple of days after position was taken:

http://www.marketwatch.com/

Trade well and take care!

The MadScientist

8 May 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Labels:

MadScientist's Market Analyses

Thursday, March 29, 2012

Beware - 29 March 2012

As I write this, our system Sell signals were given last week, and today looks very much like another Sell signal (even at midday). Last's week's signals were not violated and a failed new high closing together with technicals suggest a pullback in the cards, over the next week... albeit a slight relief from the beginning of the month rallies, but at this point, looks like a target of 1260 or a breakout over 1402 on the ES.

Click on image to enlarge.

29 March 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Click on image to enlarge.

The MadScientist

29 March 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Labels:

MadScientist's Market Analyses

Monday, February 27, 2012

Glass ceiling - 27 February 2012

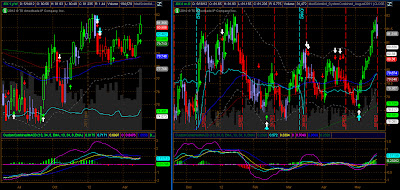

In an analysis done in the late morning of Monday's trading, here is what I am seeing from the S&P500 futures (ES charts)...

The weekly chart (left) has perfected a Sell Setup and hit resistance outlined by July 2011 high. The past two weeks is basically a stall, rather than a pause, and the Force Index is hinting that the rally in recent weeks is not an accumulation phase. Given that the weekly price level is exceeding the maniac levels. This is the first warning that the next couple of months may see a good retracement/correction... now, we just need a reason to start it all rolling, something that should be within the next couple of weeks. (Watch Greece Lightning in mid-March!)

The daily chart (top right) is showing an obvious bearish divergence amid a stall. The daily chart close up (bottom panel) has a new Buy Setup that is just initiated, and needs to end below 1360 today to continue its reversal, making a breakdown of 1350 very highly probably this week. It could well exhaustively break above 1360 and return through the range to breakdown as well. For now, the downside risk is much greater than 2 weeks ago.

I'd leave you with these words: CAUTION x 2

27 February 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

The weekly chart (left) has perfected a Sell Setup and hit resistance outlined by July 2011 high. The past two weeks is basically a stall, rather than a pause, and the Force Index is hinting that the rally in recent weeks is not an accumulation phase. Given that the weekly price level is exceeding the maniac levels. This is the first warning that the next couple of months may see a good retracement/correction... now, we just need a reason to start it all rolling, something that should be within the next couple of weeks. (Watch Greece Lightning in mid-March!)

The daily chart (top right) is showing an obvious bearish divergence amid a stall. The daily chart close up (bottom panel) has a new Buy Setup that is just initiated, and needs to end below 1360 today to continue its reversal, making a breakdown of 1350 very highly probably this week. It could well exhaustively break above 1360 and return through the range to breakdown as well. For now, the downside risk is much greater than 2 weeks ago.

I'd leave you with these words: CAUTION x 2

The MadScientist

27 February 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Labels:

MadScientist's Market Analyses

Wednesday, February 15, 2012

The day after Valentines - February 15, 2012

AH!

It seems that when you rock the boat so hard, you tend to be balancing for your dear life quite a bit.

And that is what has been happening to me for the past 2 months or so... it's not been an easy task to balance the extremes of life's journey, but I am glad I am doing ok for now.

I am looking forward to more refinement and streamlining to make things less technical, and more accurate in 2012. This would be in line with the other parts of my career that I am pursing.

I am good at what I do... and I want to be better!

So, what has been happening since the beginning of the year? A nice rally is what it is, if you missed it. Which is kinda tough to do as the rally has turned the tables on last August's rout... or has it?

Again, I find myself available to look at the charts, just before a decisive action is about to take place...

ES futures (S&P500 E-mini futures)

From the chart below, the year started with an impressive rally, and it turned the bearish outlook around having tested and failed to bread the weekly 200MA. The current rally, however, looks tired and near exhaustion. Recent high probability daily sell signals were voided and technical indicators were not too excitable following the mania in the prices just now. Notice that that candles are grey in colour? I am waiting for an impending sell signal, which should appear some time next week, perhaps after an exhaustion spike later this week, if at all. The charts are telling me something: CAUTION.

DX futures (USD futures)

The USD futures are longer term bearish, but weekly prices have been well supported. The daily chart clearly sprung a buy signal, which is suggestive of lower equities in the near term. What I do not see is the news that would spark this USD rally... not yet at least. Perhaps the Greek deadline of 25th March might be it, or the mess leading to the muddle through on 25th March 2012 will contribute?

VXX (VIX futures ETF)

Volatility had been falling well for the past 1.5 months, and the cycle is about to reverse. The weekly charts are stalling and the daily chart has buy signals. It appears to be a ripe time for an increase in volatility, and if so, this warns of an exhausted ES rally into correction phase.

TLT (Bond ETF)

Money hasn't really been pouring into the bond market since late last year. Daily moving average supports have been tested and buy signals given. This suggests a possible start of a bond rally if supports hold.

15 February 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

It seems that when you rock the boat so hard, you tend to be balancing for your dear life quite a bit.

And that is what has been happening to me for the past 2 months or so... it's not been an easy task to balance the extremes of life's journey, but I am glad I am doing ok for now.

I am looking forward to more refinement and streamlining to make things less technical, and more accurate in 2012. This would be in line with the other parts of my career that I am pursing.

I am good at what I do... and I want to be better!

So, what has been happening since the beginning of the year? A nice rally is what it is, if you missed it. Which is kinda tough to do as the rally has turned the tables on last August's rout... or has it?

Again, I find myself available to look at the charts, just before a decisive action is about to take place...

ES futures (S&P500 E-mini futures)

From the chart below, the year started with an impressive rally, and it turned the bearish outlook around having tested and failed to bread the weekly 200MA. The current rally, however, looks tired and near exhaustion. Recent high probability daily sell signals were voided and technical indicators were not too excitable following the mania in the prices just now. Notice that that candles are grey in colour? I am waiting for an impending sell signal, which should appear some time next week, perhaps after an exhaustion spike later this week, if at all. The charts are telling me something: CAUTION.

DX futures (USD futures)

The USD futures are longer term bearish, but weekly prices have been well supported. The daily chart clearly sprung a buy signal, which is suggestive of lower equities in the near term. What I do not see is the news that would spark this USD rally... not yet at least. Perhaps the Greek deadline of 25th March might be it, or the mess leading to the muddle through on 25th March 2012 will contribute?

VXX (VIX futures ETF)

Volatility had been falling well for the past 1.5 months, and the cycle is about to reverse. The weekly charts are stalling and the daily chart has buy signals. It appears to be a ripe time for an increase in volatility, and if so, this warns of an exhausted ES rally into correction phase.

TLT (Bond ETF)

Money hasn't really been pouring into the bond market since late last year. Daily moving average supports have been tested and buy signals given. This suggests a possible start of a bond rally if supports hold.

GC (Gold futures)

The gold futures weekly chart is at a downtrending channel resistance, with less than favourable candlesticks over the last 3 weeks. Weekly indicators look weak, and the daily chart has given sell signals with accompanying bearishly looking technical indicators.

Overall, while the longer term picture does seem a tad bullish, the immediate term is suggesting a bearish/corrective outlook. How this correction develops and its fundamental reason for correcting may set the backdrop for months to come. I'd be slightly bearish and very cautious as it is obvious that there is compelling confluence between the equity-USD-volatility-Gold-bond markets, all which point to a turning point and a decent correction in equities.

The MadScientist

15 February 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform

Labels:

MadScientist's Market Analyses

Subscribe to:

Posts (Atom)