It's been a while, and during this time, there has been a nice dead cat bounce.

Today's post is about a possible end to this dead cat bounce rally as we are technically at a decision point turnaround.

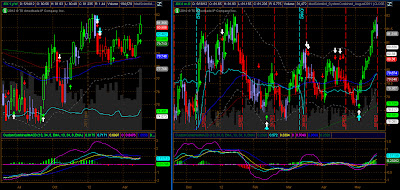

/ES

The weekly ES (S&P500 futures) chart show a bounce off the moving averages and a possible failure to make a new high. What is not seen is a reversal of a trend IF the ES closes at its current level or below this Friday. Zooming into the daily ES chart, a uptrending support line is just about to be broken. Having a Sell Signal earlier in the week, with extended indicators as well as a potential bearish crossover of the moving averages, a break of this uptrending support line would see the daily 200 moving average be the next support test, which coincides with the previous low. Price action beyond this low by Friday means a break of the weekly and daily uptrend.

In essence, it technically looks like a turnaround point... however, we are looking for trigger events to bring this successfully into fruition and with much further downside.

/DX

The USD futures weekly and daily charts are showing a renewed interest in a rally. With a new recent high made, it indicates a continuation of the rally un USD. With this, a drop in equities (ES) is correlated. The recent run up in the USD is technically supported by indicator as well as moving averages and the market fueling of the EUR/USD dumping to all time lows

/GC

This is a favourite... cos it is a tad challenging. So many people I know are so bullish on Gold, that it is about time Gold does some distribution. The weekly gold futures chart show the recent Gold double top peaks that had prices test 1550 on many occasions. There seems to be a traiangle formation and indicators are showing a potential divergence. Yet, gold is not breakout and have been ranging over the ast few weeks. The daily charts show that clearly and uite differently show prices below the moving averages with undecided price action and technicals. All said, the range bounadries are closing in and a breakout or breakdown is due... watch for this.

/CL

Crude futures in recent weeks have had a tough time, and clearly breaking an uptrend. Expect a short term bounce and consolidating range between 80-90.

So there... things are at some decision point. My warnings of a fall in the markets since March 2012 had materialized in May 2012 and since the market has had a bounce... possibly a dead cat bounce. Between now and October, something might happen to pull the markets one way or another... something not seen. IF the markets rally, it is likely to overextend itself and not expecting it to be higher than the high at the beginning of the year. This may be a setup just like it was in July 2008 to September 2008. I am looking for the signs... it might do us all well to keep a look out too.

Fundamentally, everyone is yet again bailing and easing... this time, the markets aren't reacting with that much favour. One might ask oneself why so... and let's keep our eyes out for the answer.

Have a good weekend ahead!

The MadScientist

13 July 2012

Note: ALL material posted here is from my personal opinion, and my opinion may differ or change without notice. These do NOT constitute as solicitation, investment nor financial advice. By reading the materials presented here, Readers acknowledge the awareness that the materials are intended for educational purposes only. For investment(s) advice, related decisions and/or actions pertaining to investments, always consult your own qualified financial advisors, brokers, etc.

Charts are from TD Ameritrade Thinkorswim platform